The Single Strategy To Use For Hard Money Atlanta

Wiki Article

Hard Money Atlanta Things To Know Before You Buy

Table of ContentsThe Facts About Hard Money Atlanta RevealedThe Facts About Hard Money Atlanta RevealedThe Hard Money Atlanta IdeasThe 7-Minute Rule for Hard Money Atlanta

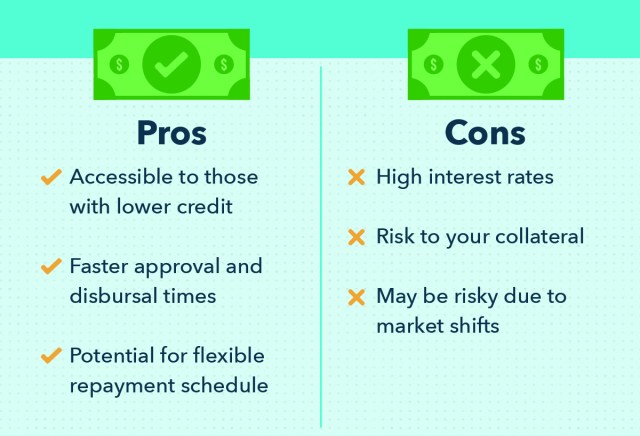

Because difficult money fundings are collateral based, also referred to as asset-based car loans, they require marginal documentation and enable capitalists to enclose a matter of days. These financings come with more danger to the loan provider, as well as as a result call for higher down repayments as well as have greater passion prices than a traditional funding.In addition to the above break down, difficult money loans as well as typical home loans have other differences that distinguish them in the minds of investors and lending institutions alike: Tough cash financings are moneyed quicker. Lots of standard finances might take one to two months to shut, however tough cash fundings can be closed in a couple of days.

Typical home loans, in comparison, have 15 or 30-year settlement terms on standard. Difficult cash finances have high-interest rates. Most hard money loan interest rates are anywhere between 9% to 15%, which is significantly greater than the interest rate you can expect for a standard home mortgage.

As soon as the term sheet is authorized, the car loan will be sent to processing. Throughout finance processing, the loan provider will certainly request papers as well as prepare the funding for last lending review as well as routine the closing.

The Facts About Hard Money Atlanta Uncovered

You'll require some capital upfront to certify for a difficult cash finance and the physical residential or commercial property to serve as security. In enhancement, difficult money car loans usually have higher passion prices than typical mortgages. hard money atlanta.

Common exit approaches include: Refinancing Sale of the property Payout from various other source There are lots of circumstances where it might be useful to make use of a difficult money financing. For beginners, actual estate financiers that like to house flip that is, purchase a review house in demand of a great deal of work, do the job directly or with service providers to make it better, after that reverse why not look here and sell it for a higher rate than they purchased for might locate hard cash car loans to be ideal funding choices.

Since of this, they don't require a lengthy term and can prevent paying too much rate of interest. If you acquire investment properties, such as rental residential properties, you may additionally locate tough money car loans to be great selections.

The Definitive Guide for Hard Money Atlanta

In some cases, you can additionally use a difficult cash loan to buy vacant land. This is a great option for designers that are in the process of getting a building and construction financing. hard money atlanta. Keep in mind that, also in the above circumstances, the potential downsides of hard cash lendings still use. You have to make sure you can repay a tough money car loan before taking it out.While these kinds of loans may sound hard and challenging, they are a commonly used funding technique lots of genuine estate investors use. What are hard money financings, and just how do they function?

Hard money car loans typically come with higher rate of interest prices and much shorter settlement timetables. Why select a tough cash finance over a standard one?

Some Known Details About Hard Money Atlanta

In addition, because personal individuals or non-institutional lenders supply tough money lendings, they are exempt to the very same policies as conventional loan providers, which make them much more risky for borrowers. Whether a hard recommended you read cash car loan is appropriate for you depends on your circumstance. Tough cash fundings are excellent options if you were denied a standard car loan as well as require non-traditional funding.Call the skilled home loan advisors at Right Begin Home Loan for additional information. Whether you desire to buy or re-finance your house, we're right here to aid. Obtain began today! Request a complimentary individualized price quote.

The application procedure will generally include an evaluation of the building's worth and also potential. This way, if you can't afford your settlements, the hard cash lending institution will merely move in advance with selling the building to this post recoup its financial investment. Hard money lenders usually charge greater passion rates than you 'd have on a traditional loan, however they additionally fund their fundings a lot more rapidly and also normally need much less paperwork.

Instead of having 15 to three decades to pay back the car loan, you'll normally have simply one to 5 years. Tough cash finances function fairly in a different way than standard car loans so it is essential to comprehend their terms and what transactions they can be used for. Hard money financings are typically meant for investment residential properties.

Report this wiki page